The future of lending

The Future of Lending Modern data and behavioural analytics are redefining risk assessment and client management. At its core lending is about trust. Traditionally, lenders have relied on a limited set of data to assess who is and is not creditworthy. This limited data means millions of potential customers have been excluded from access to […]

Embedded Finance in Lending

Emerging research and data collected through psychometric assessments are pinpointing the psychological attributes that portend a promising borrower, while detailing how to tailor products and solutions according to individual psychological traits

Psychometrics: What makes a reliable borrower? Joint Research with Mondato

Emerging research and data collected through psychometric assessments are pinpointing the psychological attributes that portend a promising borrower, while detailing how to tailor products and solutions according to individual psychological traits

7 Fuentes de Datos Modernos para el Análisis del Riesgo de Crédito en Microempresas.

MSMEs face difficulties in obtaining loans from financial institutions that use a conventional approach to creditworthiness, modern data sources can help/

7 Modern Data Sources for Credit Risk Analysis in Micro Businesses

MSMEs face difficulties in obtaining loans from financial institutions that use a conventional approach to creditworthiness, modern data sources can help/

9 trends shaping credit assessment this year

1. Inclusion of Diverse Data – there’s no alternative. Spurred by a combination of factors, Lenders are actively looking to include more and different types of data in decisioning processes. In recent years the limits of legacy credit data has been exposed. While exact models vary, legacy bureau credit scores consider the last 5 […]

Fair credit, from A to Gen Z

This article explores the unique personality characteristics of Generation Z, also known as iGen or Centennials. From their tech-savvy nature to their social inclusivity and purpose-driven mindset, discover what sets this young adult demographic apart from their predecessors.

A history of credit scores

The ways of working out who to trust in the world of credit have changed with over the years. Let’s look at the history of credit scores.

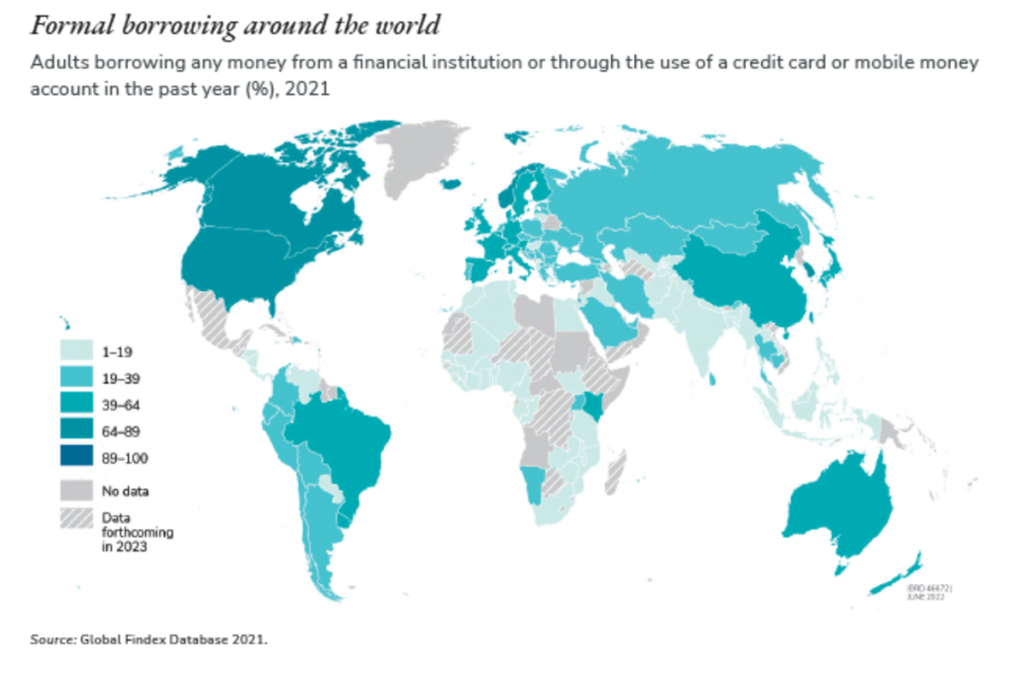

Findex Findings: Inclusion increases but the credit gap persists

The Global Findex report from the World Bank shows account ownership is increasing but credit inclusion remains a challenge.

UK Focus: Shifting economic conditions

UK regulator, the FCA (Financial Conduct Authority) has this month written directly to more than 3,500 lenders in the UK to “remind them of the standards they should meet as consumers across the country are affected by the rising cost of living. With household bills expected to continue to rise into the autumn, it is […]