Begini & Mifos Program

Credit Inclusion program Giving credit where it’s due through modern alternative data and behavioural analytics Mifos and Begini are pleased to launch the Credit Inclusion Program. Lenders are invited to take part in this initiative to advance credit responsibility and community financial health. Criteria Currently lending or looking to launch soon Able to commit […]

Begini & Mifos Webinar

Webinar: Tuesday 16 April1pm UTC Credit where it’s due Credit inclusion through modern alternative data. Attend SPEAKERS Ed Cable CEO, Mifos David Higgins Director of Programs, Mifos James Hume CEO, Begini James Florence CTO, Begini Access to fair financial services means access to opportunity. However, legacy financial services are not meeting the needs of individuals, […]

Empowering Financial Inclusion in Vietnam

The role of next-gen credit models In the bustling streets of Hanoi, where vendors hawk their goods and entrepreneurs dream of scaling their businesses, lies a tale of untapped potential. Vietnam, with its vibrant economy and dynamic population, holds promise for growth and prosperity. Yet, for many, accessing financial services remains a challenge, hindered by […]

A history of credit scores

The ways of working out who to trust in the world of credit have changed with over the years. Let’s look at the history of credit scores.

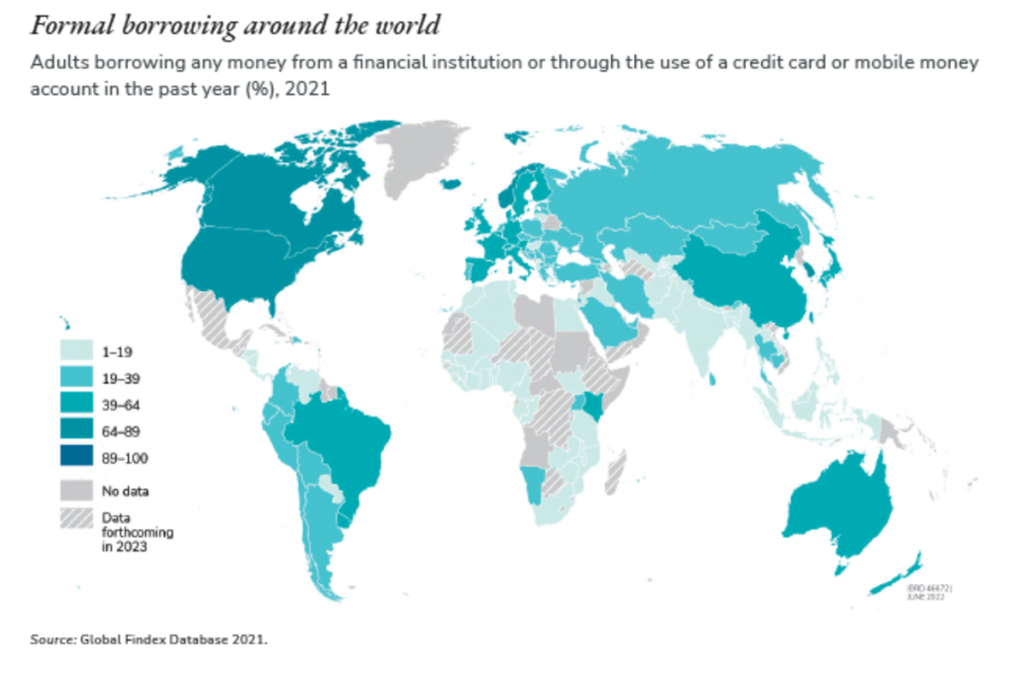

Findex Findings: Inclusion increases but the credit gap persists

The Global Findex report from the World Bank shows account ownership is increasing but credit inclusion remains a challenge.

Regional Focus: Credit inclusion in Africa

Africa is one of the most diverse continents in the world. Home to more than a billion people and making up the largest free trade area on the planet. The continent is rich in natural and human resources and has the potential to build on these to drive inclusive growth. The diversity of the continent […]

Finalist – Most Sustainable Start up

We’re pleased to be recognised as a finalist in Finnovating’s Most Sustainable Startup Awards. Sustainability is central to our mission at Begini. We believe in giving credit where it’s due. Access to credit is access to opportunity. Finnovating is a global platform of over 70,000 FinTech startups, corporations & investors to collaborate, invest and scale globally. […]

Regional Focus: Credit inclusion in Latin America

Latin America and the Caribbean is a region of diversity and contrast. While it is home to hubs of innovation and technology, challenges to financial inclusion persist. Access to financial services varies widely between regions and segments of society. It is reported that 45% of the adult population do not hold a bank account and […]

What is a thin-file customer?

The financial systems, and the world of credit, have long been ruled by processes that entrench inequality. Financial inclusion is stifled by the fact that lenders rely on outdated systems such as credit files and bureau credit ratings and scores. These processes may serve those with a thick-file well, but this leads to the exclusion […]

Putting the S in ESG

Access to credit is access to opportunity. For too long there has been a lack of access to both for millions of people. The traditional bureau credit score is based on limited data. The system advantages certain people, in turn discriminates against many others. The credit playing field is far from level today. It entrenches […]