A history of credit scores

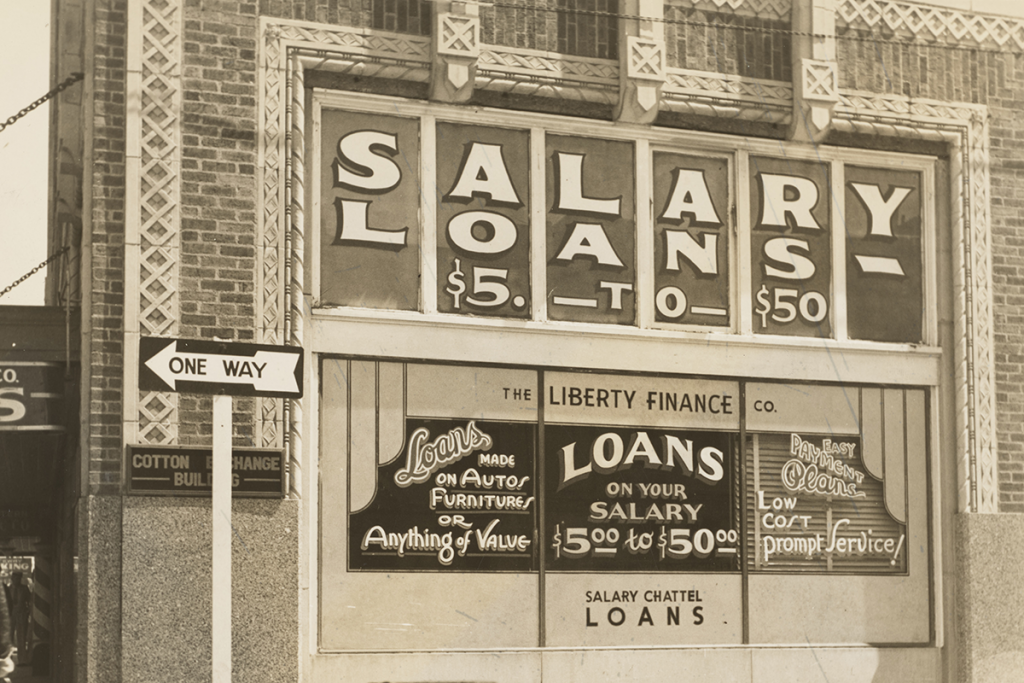

The ways of working out who to trust in the world of credit have changed with over the years. Let’s look at the history of credit scores.

UK Focus: Shifting economic conditions

UK regulator, the FCA (Financial Conduct Authority) has this month written directly to more than 3,500 lenders in the UK to “remind them of the standards they should meet as consumers across the country are affected by the rising cost of living. With household bills expected to continue to rise into the autumn, it is […]

The future of lending is first-party data

In a data-rich world, it is increasingly important to know how to select the best data source for each process. What is the difference between first-party and third-party data? And why are some lenders moving to first-party data for risk assessment? Let’s start with some definitions First-party data is data that you create or […]

11 trends shaping credit assessment this year

1. Inclusion of Alternative Data Spurred by a combination of factors, Lenders are actively looking to include more and different types of data in decisioning processes. Notably the fallout from lockdowns in recent years has exposed the limits of traditional data. While exact models vary, traditional bureau credit scores consider the last 5 to 7 […]