The 3 C’s of Credit

The three C’s are Character, Capacity and Collateral, and today they remain a widely accepted framework for evaluating creditworthiness, used globally by banks, credit unions and lenders of all types.

Fair credit, from A to Gen Z

This article explores the unique personality characteristics of Generation Z, also known as iGen or Centennials. From their tech-savvy nature to their social inclusivity and purpose-driven mindset, discover what sets this young adult demographic apart from their predecessors.

What an alternative credit score should never check

Predictive credit insights with zero personal data. Credit scores are changing, considering more diverse data than ever before. But while more data can be considered, not all of it should be. Personal information does not need to be shared for an alternative data credit assessment. Today, financial businesses are incorporating new data sources, such as […]

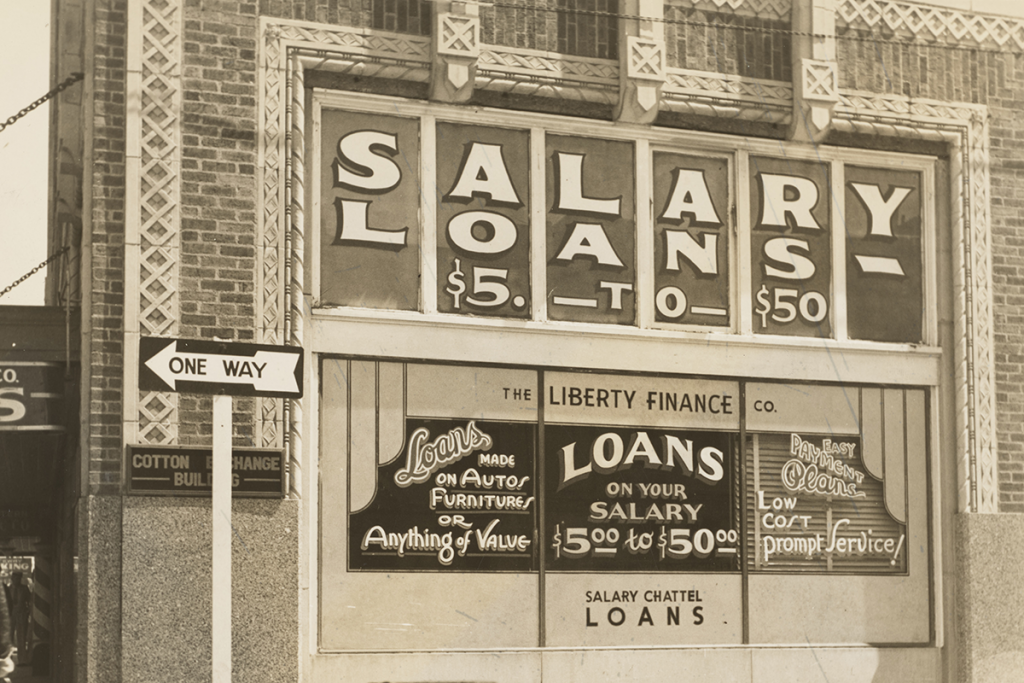

A history of credit scores

The ways of working out who to trust in the world of credit have changed with over the years. Let’s look at the history of credit scores.

Hablando de datos alternativos

¿Cómo se pueden aprovechar los principios de la personalidad y de la economía conductual en el mundo de la evaluación del riesgo de crédito? Ese fue el tema de discusión en la conferencia Ciclo de Riesgo celebrada recientemente en Colombia. Vea la ponencia de Begini a través del Head para Latinoamérica – Rodrigo Rocha. https://youtu.be/a1eaunCYl14 […]

UK Focus: Shifting economic conditions

UK regulator, the FCA (Financial Conduct Authority) has this month written directly to more than 3,500 lenders in the UK to “remind them of the standards they should meet as consumers across the country are affected by the rising cost of living. With household bills expected to continue to rise into the autumn, it is […]

The future of lending is first-party data

In a data-rich world, it is increasingly important to know how to select the best data source for each process. What is the difference between first-party and third-party data? And why are some lenders moving to first-party data for risk assessment? Let’s start with some definitions First-party data is data that you create or […]

What is a psychometric assessment?

And how can it help your credit score? If we want to measure temperature, we use a thermometer. But how can we measure variables like knowledge and attitudes? We use a psychometric assessment. The term ‘Psychometrics’ sounds intimidating and complicated, but essentially it refers to the ability to measure psychological traits. Psychometric assessments can objectively […]

Regional Focus: Credit inclusion in Africa

Africa is one of the most diverse continents in the world. Home to more than a billion people and making up the largest free trade area on the planet. The continent is rich in natural and human resources and has the potential to build on these to drive inclusive growth. The diversity of the continent […]

Finalist – Most Sustainable Start up

We’re pleased to be recognised as a finalist in Finnovating’s Most Sustainable Startup Awards. Sustainability is central to our mission at Begini. We believe in giving credit where it’s due. Access to credit is access to opportunity. Finnovating is a global platform of over 70,000 FinTech startups, corporations & investors to collaborate, invest and scale globally. […]