Modern data and behavioural analytics are redefining risk assessment and client management.

At its core lending is about trust. Traditionally, lenders have relied on a limited set of data to assess who is and is not creditworthy. This limited data means millions of potential customers have been excluded from access to fair credit. Around 10% of UK adults, approximately 5.6 million people, are considered “credit invisible”

However, as the world becomes increasingly digital, so do both the challenges and opportunities for lenders. Modern data sources are revolutionising the way lenders assess creditworthiness, prevent fraud, and build lasting client relationships.

Two companies forging new approaches to lending are Behavioural Financial Consulting and Begini. These companies take a modern approach to lending, offering data-driven insights and innovative technologies to pave the way for smarter, more personalised lending experiences.

Imagine a world where every loan applicant, regardless of their financial background, is assessed with a level playing field. This is possible by integrating behavioural analytics into the risk assessment process. Traditional credit scores often fall short in capturing the diverse range of human behaviours. Begini’s approach goes beyond the numbers, analysing behavioural traits that correlate with credit risk.

By partnering with risk teams, we help make lending decisions that are not only fairer but also more predictive and inclusive. Whether you’re assessing individuals or businesses, data-driven insights provide a comprehensive view that traditional methods simply cannot offer.

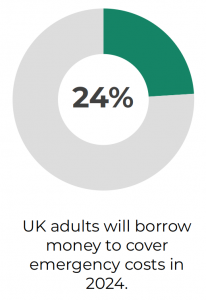

The way people use credit is also changing. Lenders need solutions to help provide fair credit options in non-traditional lending use cases. For example, in the UK over 13 million people, or 24% of adults, borrow money to cover emergency costs.

As digital transformation reshapes customer journeys, the risk of fraud evolves alongside it. For UK insurers alone, the cost of fraudulent claims in 2022 was estimated at £1.1 billion, with almost 72,600 cases of fraud detected.

New technologies bring convenience, but they also open the door to new fraud schemes. That’s why incorporating behavioural data can strengthen your anti-fraud defence. By analysing patterns and interactions, Begini can detect fraudulent behaviour early and throughout the customer journey. Begini’s system identifies devices with a history of fraudulent activity and performs KYCD (Know Your Customer’s Device) checks, ensuring that multiple device applications are flagged. This proactive approach not only protects the lender but also enhances the security of the entire lending ecosystem.

Effective communication is the cornerstone of a strong client relationship. Behavioural Financial Consulting tailor communication strategies based on each client’s risk tolerance and financial goals. By providing clear, personalized advice, lenders can guide borrowers through their financial journey, helping them stay on track with repayments and avoid defaults. This ongoing support not only improves financial health but also strengthens loyalty to the brand.

Managing risk doesn’t end once a loan is approved. Behavioural Financial Consulting offers strategies to monitor compliance with lending policies and identify potential issues early on. By conducting thorough background checks and engaging proactively with high-risk customers, you can prevent defaults before they happen. Educating borrowers on risk mitigation, developing strategic repayment plans, and ensuring adherence to these plans foster a culture of financial responsibility among your clients.

One size does not fit all, especially when it comes to financial products and services. Behavioural Financial Consulting support lenders to continuously refine offerings based on updated risk profiles, ensuring they align with your clients’ evolving needs. By anticipating client behaviour, we help you design loan products that cater to different borrower segments, offering flexible repayment options that make managing finances easier. Targeted marketing campaigns can ensure that the right products reach the right clients, increasing engagement and building enduring relationships with your customers.

Why ask someone to describe their abilities when you can allow them to show you? Begini’s next-generation digital psychometric tests use gamification to reveal true potential. These scientifically valid assessments delve into personality, cognitive abilities, and skills, providing a more accurate prediction of an applicant’s willingness to repay. By comparing these profiles with others, it is possible to gain a deeper understanding of each individual’s likelihood of default, allowing for more informed lending decisions. Organisations using gamification have seen a 700% increase in customer acquisition.

The number of smartphone subscriptions worldwide is expected to exceed 7.2 billion in 2024. In a world dominated by smartphones, the way we use our devices speaks volumes about our behaviour. Our solution captures privacy-consented metadata from users’ devices, providing valuable insights in under a minute. This low-friction, GDPR-compliant process can be seamlessly integrated into your app or website, offering a powerful tool for assessing risk and predicting behaviour. With device behavioural data, you gain a real-time understanding of your customers, enabling you to make smarter, data-driven decisions.

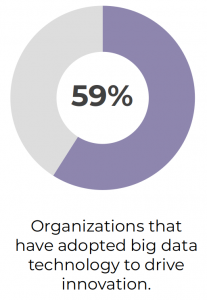

Data can be complex but leveraging it shouldn’t be. Begini’s Data Science as a Service (DSaaS) simplifies the process, offering a practical framework for unlocking the full potential of your data. DSaaS lets lenders leverage expert data scientists to work closely with your team to analyse and interpret data, transforming it into actionable insights that drive your business forward. Whether you’re looking to enhance customer experience, optimise operations, or make strategic decisions, a DSaaS solution provides the expertise and technology you need to succeed. 59.5% of organisations have already adopted big data technology to drive innovation with the help of data.

Building trust and loyalty is more important than ever in today’s market. Behavioural Financial Consulting uses data analytics to gain deep insights into client needs, preferences, and behaviours, helping lenders stay ahead of the curve. We help you refine your offerings to meet evolving client expectations, ensuring your brand stays relevant and compelling. Our storytelling approach fosters an emotional connection between clients and your brand, aligning your products and services with their values and goals.

Predictive analytics is key to anticipating client needs and personalizing their experiences. Behavioural Financial Consulting build robust models that identify patterns in customer behaviour, helping you understand their preferences and likely future actions. These insights allow you to craft personalized customer journeys, improve product development, and innovate services that resonate with your audience. The alignment of your offerings with customer preferences enhances engagement, satisfaction, and ultimately, business success.

Measuring success is essential for growth. Our approach to performance measurement and KPIs provides a clear view of your business’s effectiveness, helping you stay on track with your goals. We monitor customer satisfaction, retention, and segment performance, identifying strengths and weaknesses in your client management strategy. We help you mitigate risks and enhance overall client engagement, driving stronger client engagement and ensuring a successful and sustainable business.

The future of lending and client management lies in the ability to adapt, innovate, and personalise. By embracing modern data solutions and behavioural insights, we empower you to make smarter, more informed decisions that drive profitability and build lasting client relationships. Welcome to a new era of lending—one where data meets human insight, and every client is understood, valued, and served to the best of their needs.