Digital payments climb and account ownership reaches new heights, but challenges remain in many markets, with access to credit and savings still out of reach for too many.

These are the findings of The World Bank 2021 Global Findex, the most comprehensive study of Financial Inclusion. The report, released last month, showed some promising steps on the journey to financial fairness. Account ownership has climbed to 76 per cent worldwide – and 71 per cent in developing countries.

Account ownership is a key driver of economic development. Having an account makes it easier to invest in a business, manage finances or save for health or education.

The report considers someone is ‘banked’ if they have access to any sort of basic transaction account – this could be with a traditional financial institution (like a bank), a digital or neo bank or a mobile money account. Despite progress, today 1.4 billion adults remain unbanked.

But the journey to financial inclusion does not end with a simple account. Many account holders are ‘under banked’. This means they have some type of transaction account but lack access to fair ways to save or borrow money – important tools in building financial resilience.

Since 2020, the shift towards digital has taken a giant leap forward. The pandemic, and necessity of social distancing, led to a rapid increase in digital payments. Two-thirds of adults worldwide now make or receive a digital payment. In developing economies users of digital payments grew from 35% of adults in 2014 to 57% in 2021.

The report found those that received a payment into a digital account were more likely to access other formal financial services – such as savings or credit.

“This growth is great news because it means that more low-income people—and especially low-income women—are being empowered to use products that let them make and receive payments, save and borrow money, and get insurance. Both research and experience show that this financial inclusion helps people exit and stay out of poverty.” – Bill Gates, The Global Findex is supported by the Gates Foundation.

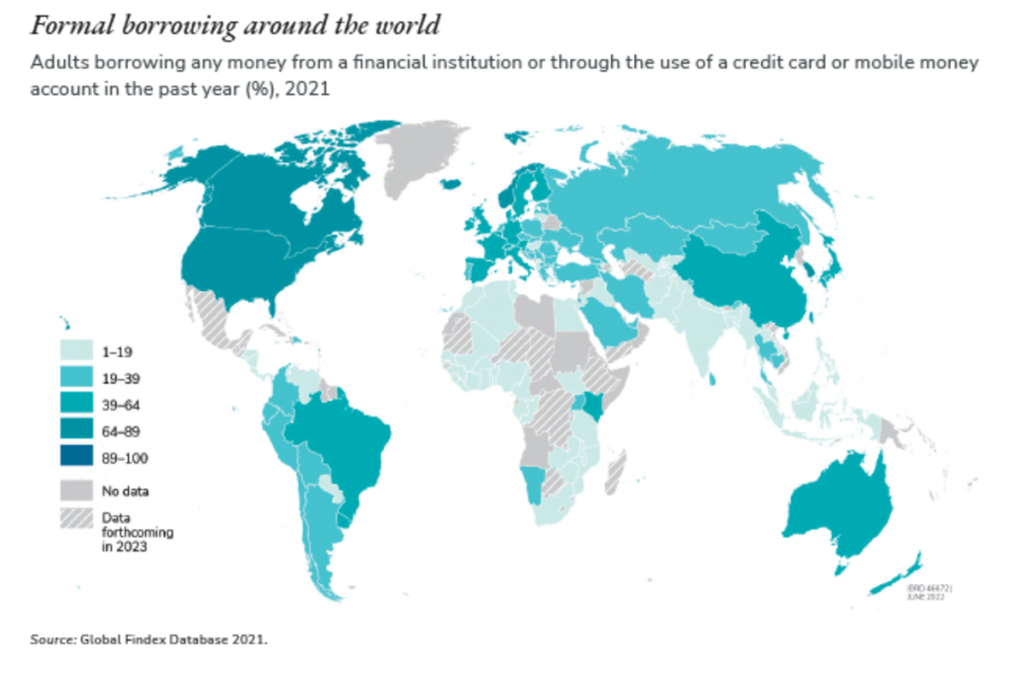

A lack of access to fair, formal credit remains a sobering reality for most adults in developing countries. The report found 77% of adults in these regions did not access any formal form of credit in the reporting period.

While about half of all adults in developing economies borrowed money in the last 12 months – only 23% used formal methods (up from 16% in 2017). This means more than half borrowed from informal channels, such as family and friends. While, informal credit channels are important in many markets, they are not without risk to the borrower and access is unlikely to equitable. This can disadvantage those that are the most financially vulnerable.

Access to credit is an area with room for significant improvement. Access to fair credit means access to opportunity. It means the ability to access higher income generating investments – such as new equipment for a business.

A barrier to expanding credit in developing countries has been the limitations of traditional credit assessments. While a lender may want to lend to those with no credit history, the incumbent legacy score system simply does not allow it.

Lenders in all markets should take this report as a reminder that there is a duty to ensure fair access to credit in their market. This means finding new ways to provide credit assessment – particularly for those who lack a traditional financial history.

Alternative data, machine learning and AI presents an opportunity for lenders to increase approvals while maintaining risk levels.

At Begini, we are working towards giving lenders a better data to make more profitable and informed decisions – helping them lend to more good borrowers, regardless of their history.